Is Deepak Nitrite a Safe Long-Term Investment?

Is Deepak Nitrite a Safe Long-Term Investment? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the world of Deepak Nitrite, we uncover a company steeped in history, driven by innovation, and poised for long-term success.

Overview of Deepak Nitrite

Deepak Nitrite Limited is a leading chemical manufacturing company in India with a rich history dating back to 1970. Over the years, the company has established itself as a key player in the chemical industry, known for its high-quality products and innovative solutions.The core business areas of Deepak Nitrite include Basic Chemicals, Fine & Speciality Chemicals, and Performance Products.

The company produces a wide range of products such as phenol, acetone, basic chemicals, and specialty chemicals used in various industries like agriculture, pharmaceuticals, and textiles.Currently, Deepak Nitrite holds a strong market position in the chemical industry, with a focus on sustainable growth and expansion.

The company has been experiencing a positive growth trajectory, driven by its commitment to innovation, quality, and customer satisfaction.

Financial Performance Analysis

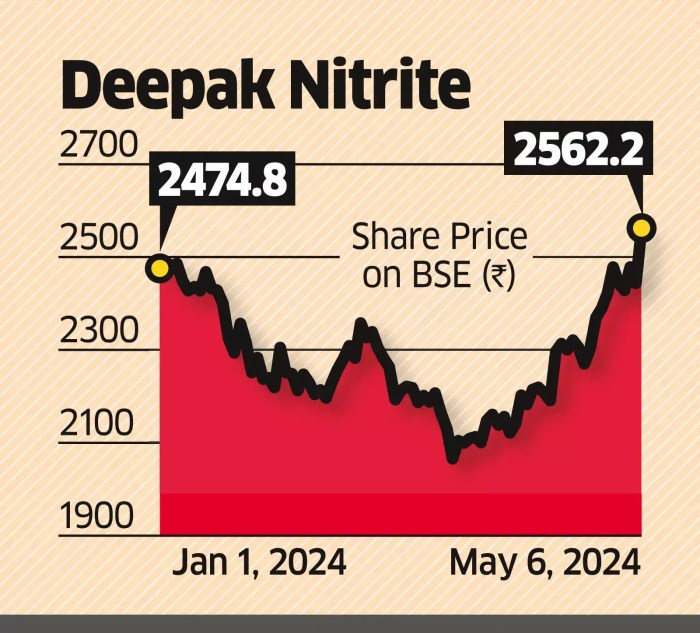

When analyzing Deepak Nitrite's financial performance over the past few years, it is essential to look at key indicators such as revenue growth, profitability, and margins in comparison to its industry peers. Additionally, recent trends and events that have impacted the company's financial performance should be taken into consideration.

Revenue Growth

Deepak Nitrite has shown consistent revenue growth over the past few years, outperforming many of its competitors in the industry. The company has been able to increase its top line through strategic acquisitions and diversification of its product portfolio.

Profitability and Margins

When it comes to profitability, Deepak Nitrite has maintained healthy margins despite facing challenges in the market. The company's focus on operational efficiency and cost management has helped sustain its profitability levels, making it an attractive investment option.

Recent Trends and Events

Recent trends and events, such as the global economic slowdown and fluctuations in raw material prices, have impacted Deepak Nitrite's financial performance. However, the company has shown resilience in adapting to these challenges and implementing strategic measures to mitigate risks and capitalize on emerging opportunities.

Industry and Market Analysis

When analyzing Deepak Nitrite as a potential long-term investment, it is crucial to consider the industry trends and market dynamics that could impact the company's performance.

Industry Trends and Market Dynamics

Deepak Nitrite operates in the specialty chemicals industry, which has been experiencing steady growth due to increasing demand from various sectors such as pharmaceuticals, agrochemicals, and performance products. The industry is driven by factors like technological advancements, sustainability initiatives, and the need for high-quality chemicals.

Key Competitors and Market Share

Deepak Nitrite faces competition from players like Aarti Industries, Navin Fluorine International, and Atul Ltd. These competitors have a significant market share in the specialty chemicals segment and are constantly innovating to maintain their competitive edge. Deepak Nitrite's market share and performance in comparison to these key competitors are essential considerations for investors.

Regulatory and Macroeconomic Factors

The specialty chemicals industry is heavily regulated, with compliance requirements impacting operations and costs. Factors such as environmental regulations, trade policies, and raw material prices can significantly influence the industry's performance. Additionally, macroeconomic factors like GDP growth, inflation rates, and currency fluctuations can impact the demand for specialty chemicals and overall market conditions.

Long-Term Investment Viability

Investing in Deepak Nitrite for the long term requires a thorough analysis of its competitive advantages, growth potential, and sustainability. Let's delve into these factors to determine if it is a safe bet for long-term investors.

Competitive Advantages and Moat

Deepak Nitrite has established a strong presence in the chemical industry, with a diverse product portfolio catering to various sectors such as agrochemicals, pharmaceuticals, and performance products. The company's vertically integrated operations and robust R&D capabilities provide it with a competitive edge.

Additionally, its strong relationships with customers and suppliers contribute to building a sustainable moat around its business.

Long-Term Growth Potential and Sustainability

Deepak Nitrite's strategic focus on innovation and sustainability positions it well for long-term growth. The company's expansion plans, both domestically and internationally, indicate a commitment to capturing new markets and enhancing its revenue streams. Moreover, its adherence to environmental regulations and emphasis on sustainable practices bode well for its future sustainability.

Management Quality, Innovation, and Industry Disruptions

The quality of management plays a crucial role in determining a company's long-term success. Deepak Nitrite's leadership team has a proven track record of steering the company through challenges and capitalizing on opportunities. Their focus on innovation, evidenced by ongoing R&D initiatives and new product development, ensures that the company stays ahead of industry disruptions and remains competitive in a rapidly evolving market.

Closing Summary

In conclusion, the question of whether Deepak Nitrite is a safe long-term investment is complex yet intriguing. By examining its past, present, and future prospects, investors can make informed decisions in the ever-evolving market landscape.

FAQ Overview

Is Deepak Nitrite financially stable for long-term investment?

Deepak Nitrite has shown consistent growth and profitability over the years, making it a potentially safe long-term investment option.

What are the key factors that make Deepak Nitrite a viable long-term investment?

Deepak Nitrite's competitive advantages, strong market position, and sustainable growth potential are key factors that contribute to its viability as a long-term investment.

Are there any risks associated with investing in Deepak Nitrite for the long term?

While Deepak Nitrite shows promise, like any investment, there are risks involved such as industry competition, market fluctuations, and regulatory changes that investors should consider.

How does Deepak Nitrite's financial performance compare to its industry peers?

Deepak Nitrite has outperformed many of its industry peers in terms of revenue growth and profitability, indicating its strength in the market.