GM Stock vs. Tesla: Which Is Better for Portfolio Growth?

GM Stock vs. Tesla: Which Is Better for Portfolio Growth? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the comparison between GM Stock and Tesla, we uncover a landscape filled with financial intricacies and strategic maneuvers that shape the investment potential of these automotive giants.

Background Comparison

When looking at the history and growth trajectory of GM stock, we see a company with a long-standing presence in the automotive industry. General Motors, founded in 1908, has weathered market fluctuations and economic challenges over the years. Despite facing bankruptcy during the financial crisis of 2008-2009, GM has since rebounded and shown resilience in its operations.

Tesla, on the other hand, represents a more recent player in the automotive market. Established in 2003, Tesla has quickly risen to prominence as a leader in electric vehicle innovation. The company's focus on sustainable energy and cutting-edge technology has disrupted the traditional automotive industry and garnered significant attention from investors and consumers alike.

Market Performances

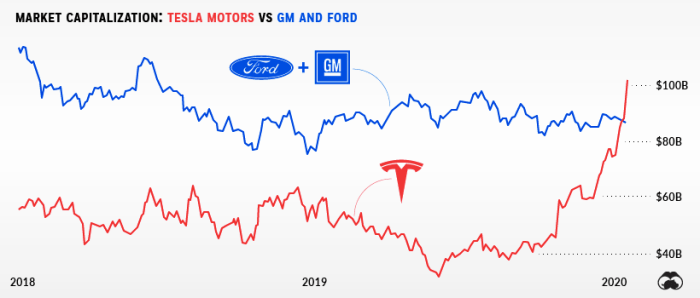

- Over the past few years, GM stock has shown a relatively stable performance, with fluctuations influenced by factors such as market conditions, economic indicators, and company-specific news. The stock has experienced periods of growth and decline, reflecting the cyclical nature of the automotive industry.

- Tesla, on the other hand, has seen exponential growth in its stock price, fueled by investor optimism, technological advancements, and a strong brand presence. The company's innovative approach to electric vehicles and renewable energy has positioned it as a frontrunner in the industry, leading to a surge in market value.

Financial Health Assessment

When evaluating the financial health of companies like GM and Tesla, it is crucial to analyze key financial metrics to understand their current standing and potential for growth.

Financial Statements Analysis

- Looking at the latest financial statements of GM and Tesla can provide insights into their revenue, expenses, and overall financial performance.

- Analyzing the balance sheets, income statements, and cash flow statements can help investors gauge the stability and profitability of each company.

Key Financial Ratios

- The Price-to-Earnings (P/E) ratio is a measure of how much investors are willing to pay for each dollar of earnings. A lower P/E ratio may indicate a potentially undervalued stock.

- The Debt-to-Equity ratio shows the proportion of debt and equity used to finance a company's assets. A lower ratio is generally considered more favorable as it signifies lower leverage.

- Profit margins, such as gross margin, operating margin, and net margin, reflect how efficiently a company is managing its costs and generating profits.

Recent Financial Developments

- GM may have announced a new partnership or product launch that could impact its stock performance positively.

- Tesla might have reported record-breaking sales figures or expansion plans that could drive its stock price up.

- Changes in interest rates, economic conditions, or regulatory environments can also influence the financial outlook for both GM and Tesla.

Market Positioning and Strategy

In the highly competitive automotive industry, market positioning and strategy play a crucial role in determining the success of companies like GM and Tesla. Let's delve into how each company positions itself and the strategies they employ for growth.

GM's Market Positioning and Strategic Initiatives

General Motors (GM) has a long-standing presence in the automotive industry, with a focus on producing a wide range of vehicles to cater to diverse consumer needs. GM's market positioning is built on a legacy of innovation and reliability, with brands like Chevrolet, Cadillac, and GMC under its umbrella.

In recent years, GM has also shown a commitment to sustainability by investing in electric and autonomous vehicle technology.

- GM's Strategic Initiatives:

- Investing in electric vehicles (EVs) and autonomous driving technology to stay competitive in the evolving market.

- Expanding its global footprint by entering emerging markets and forming strategic partnerships.

- Emphasizing customer-centric innovation to meet changing consumer preferences and demands.

Tesla's Market Strategies and Focus

Tesla, on the other hand, has disrupted the automotive industry with its focus on innovation, particularly in the electric vehicle segment. The company is known for its cutting-edge technology, sleek designs, and commitment to sustainability. Tesla's market positioning revolves around being a leader in the EV market and pushing the boundaries of what is possible in the automotive industry.

- Tesla's Market Strategies:

- Continuous focus on research and development to introduce new and advanced features in its vehicles.

- Building a strong brand image through direct-to-consumer sales and unique marketing strategies.

- Expanding beyond the automotive sector into energy storage solutions and solar technology.

Market Share and Global Presence Comparison

When it comes to market share and global presence, GM has a more established presence worldwide compared to Tesla. GM's traditional approach to manufacturing and distribution has allowed it to reach a broader audience, especially in markets where Tesla is still expanding its footprint.

However, Tesla's innovative products and growing popularity in the EV market have positioned it as a formidable competitor to GM, particularly in the electric vehicle segment.

While GM focuses on a wide range of vehicles and traditional manufacturing, Tesla's emphasis on innovation and sustainability has reshaped the automotive industry.

Technological Advancements and Innovation

Electric vehicles and autonomous driving technologies are at the forefront of innovation in the automotive industry, with General Motors (GM) and Tesla being key players in this space.

Electric Vehicle Advancements

GM has been making significant strides in electric vehicle technology with its Ultium platform, which allows for flexible battery configurations and efficient production. This platform is the foundation for GM's electric vehicle lineup, including the Chevy Bolt EV and upcoming electric models.

On the other hand, Tesla has been a pioneer in the electric vehicle market, with its models like the Model S, Model 3, Model X, and Model Y setting the benchmark for performance, range, and technology in the industry.

Autonomous Driving Innovations

Both GM and Tesla are investing heavily in autonomous driving technology to enable self-driving capabilities in their vehicles. GM's Super Cruise system offers hands-free driving on compatible highways, while Tesla's Autopilot system provides advanced driver-assistance features.

Tesla's Full Self-Driving (FSD) package aims to achieve full autonomy, while GM's Cruise Automation division is working on developing a fully autonomous vehicle for ride-sharing services.

Influence on Stock Performance

The technological advancements and innovations in electric vehicles and autonomous driving play a crucial role in shaping the stock performance and growth potential of GM and Tesla. Investors closely monitor developments in these areas as they can significantly impact consumer demand, competitive positioning, and long-term sustainability in the market.

Final Review

In conclusion, the battle between GM Stock and Tesla for portfolio growth is a nuanced one, with each company showcasing unique strengths and opportunities. Investors must carefully weigh the financial health, market positioning, and technological advancements of both entities to make informed decisions for their portfolios.

Question Bank

Which company has a better historical growth trajectory: GM or Tesla?

In terms of historical growth trajectory, Tesla has outperformed GM with its meteoric rise in the market driven by innovation and consumer demand for electric vehicles.

What key financial ratios should investors consider when comparing GM Stock and Tesla?

Investors should focus on metrics like P/E ratio, debt-to-equity ratio, and profit margins to assess the financial health and performance of GM Stock and Tesla.

How do GM and Tesla differ in their market positioning strategies?

GM focuses on traditional automotive market segments while Tesla emphasizes innovation and sustainability, targeting the electric vehicle market with disruptive technologies.