Stock Portfolio Diversification Strategies for 2025: A Comprehensive Guide

Exploring the realm of Stock Portfolio Diversification Strategies for 2025 reveals a landscape filled with opportunities and challenges. As we delve into the intricacies of diversification, we uncover the key principles and emerging trends that shape the future of portfolio management.

Join us on this journey as we navigate through traditional strategies, new innovations, and global considerations in the quest for a well-rounded investment portfolio.

Importance of Stock Portfolio Diversification

Diversification is a crucial aspect of stock portfolio management as it helps spread out investment risk across different assets. By holding a variety of investments within a portfolio, investors can reduce the impact of any one investment underperforming.

Risk Reduction through Diversification

- Diversification helps reduce the overall risk of a portfolio by spreading investments across different industries, sectors, and asset classes.

- For example, if one sector experiences a downturn, the impact on the entire portfolio is minimized as other sectors may perform well.

- By holding a mix of stocks, bonds, and other assets, investors can mitigate the risk associated with market volatility.

Impact on Portfolio Performance

- Studies have shown that a well-diversified portfolio tends to have more stable returns over time compared to a concentrated portfolio.

- While diversification may not eliminate all risks, it can help investors achieve a balance between risk and return.

- Investors who fail to diversify their portfolios may be exposed to higher levels of risk and potential losses if a particular investment performs poorly.

Traditional Diversification Strategies

When it comes to traditional diversification strategies in stock portfolios, investors have long relied on methods such as asset allocation and sector diversification to manage risk and optimize returns.

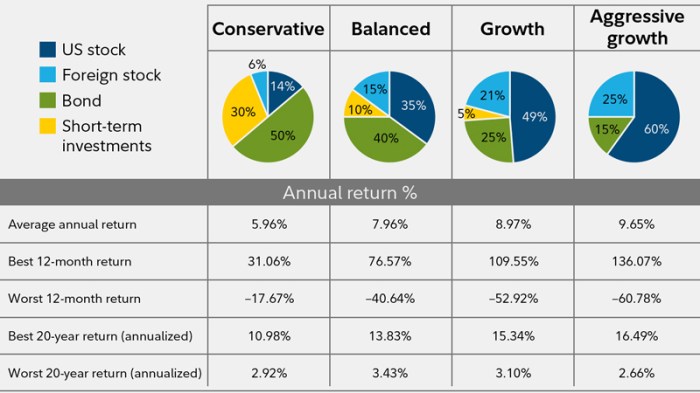

Asset Allocation

Asset allocation involves spreading investments across different asset classes, such as stocks, bonds, and cash equivalents, to reduce risk. By diversifying in this way, investors can benefit from the performance of various asset classes and minimize the impact of market fluctuations.

- For example, a conservative investor may allocate a larger portion of their portfolio to bonds for stability, while a growth-oriented investor may allocate more to stocks for higher returns.

- Effective asset allocation requires periodic rebalancing to maintain the desired risk-return profile.

Sector Diversification

Sector diversification involves investing in different industries or sectors to reduce exposure to the risks associated with a specific sector. This strategy helps protect the portfolio from downturns in any single sector while taking advantage of growth opportunities in others.

- For instance, an investor may diversify across sectors like technology, healthcare, and consumer staples to spread risk and capture growth potential in multiple areas of the economy.

- Successful sector diversification relies on thorough research and monitoring of industry trends to make informed investment decisions.

Emerging Trends in Portfolio Diversification

As we look ahead to 2025, new trends are shaping the way investors diversify their stock portfolios. These emerging strategies are influenced by advancements in technology and a growing focus on ESG considerations.

Role of Technology in Modern Diversification Strategies

Technology is playing a crucial role in modern diversification strategies, enabling investors to access a wide range of investment opportunities and optimize their portfolios. Automated robo-advisors, algorithmic trading, and artificial intelligence tools are being used to analyze market data, identify trends, and make informed investment decisions.

These technological advancements are providing investors with more efficient ways to diversify their portfolios and manage risk.

ESG Considerations in Diversification Choices

ESG (Environmental, Social, and Governance) considerations are increasingly influencing diversification choices among investors. Companies that focus on sustainable practices, social responsibility, and strong governance are becoming more attractive investment options. Investors are incorporating ESG criteria into their decision-making process to align their investments with their values and contribute to positive societal and environmental impact.

This shift towards ESG integration is shaping the way portfolios are diversified, with a greater emphasis on responsible investing.

Global vs

. Local Diversification

When it comes to diversifying your stock portfolio, you have the option to either go global or stay local. Each of these approaches has its own set of advantages and disadvantages that investors should carefully consider.

Advantages and Disadvantages of Global vs. Local Diversification

Global Diversification:

- Advantages:

- Reduced risk through exposure to a variety of economies and industries.

- Potential for higher returns due to access to emerging markets with growth potential.

- Disadvantages:

- Increased exposure to currency fluctuations, which can impact returns.

- Risk of geopolitical events affecting international markets.

Local Diversification:

- Advantages:

- Familiarity with local market conditions and regulations.

- Potential for more stable returns due to lower exposure to currency risks.

- Disadvantages:

- Limited growth opportunities compared to global markets.

- Risk of sector-specific or country-specific downturns impacting the portfolio.

Impact of Geopolitical Events on Global Diversification Strategies

Geopolitical events such as trade wars, political instability, or regulatory changes can have a significant impact on global diversification strategies. These events can lead to market volatility, affecting the performance of international investments and increasing risk for investors.

Currency Fluctuations in Global Diversification Choices

Currency fluctuations play a crucial role in global diversification choices as they can directly impact returns for investors. When investing in international markets, investors are exposed to currency risk, which can either amplify gains or lead to losses depending on how currencies fluctuate relative to each other.

It is essential for investors to consider hedging strategies to mitigate the impact of currency fluctuations on their global investments.

Closing Summary

In conclusion, Stock Portfolio Diversification Strategies for 2025 offer a dynamic approach to mitigating risks and maximizing returns in an ever-changing market environment. By embracing a diverse range of assets and staying attuned to emerging trends, investors can position themselves for success in the years to come.

Questions Often Asked

Why is diversification crucial in stock portfolio management?

Diversification helps spread risk across different assets, reducing the impact of volatility on the overall portfolio.

What are some examples of how diversification helps reduce risk?

By investing in a mix of stocks, bonds, and other asset classes, investors can minimize losses during market downturns.

How do global and local diversification differ?

Global diversification offers exposure to international markets, while local diversification focuses on domestic assets, each with unique advantages and disadvantages.